In this section the user must provide information about the applicant’s proposed project and specify the total amount of California Competes Tax Credit requested.

A. Summary of the Proposed Project

Project: The applicant's proposed business venture, investment, or expansion in this state that is the basis for award of the California Competes Tax Credit.

The project summary section has a 7000 character (i.e., letters, numbers, spaces, and punctuation) limit. The California Competes team suggests creating the summary in a word processing program that can automatically track character count, and perform spell/grammar check functions. The User can then copy/paste the final version into the application. The formatting (e.g., font, style) in this section of the application is not important as it saves as plain text.

Use this section to provide all relevant details of the project. Be sure to clearly describe the the applicant’s business and how the credit being requested will specifically enable or incentivize the proposed expansion. If needed, please use this space to expand upon the purpose, location, or scope of the project. The summary should convey a clear understanding of the types of activities that will take place such as the nature of the work (e.g., widget manufacturing), classification(s) of full-time employees being hired/retained (e.g., forklift drivers, scientists, machinists, etc.), and a general description of the nature of investments (e.g., building construction, manufacturing equipment, vehicles, etc.). Please do not provide a one-sentence response such as “Business expansion” or “Relocating manufacturing to a bigger facility in another city.”

Use this section to provide all relevant details of the project. Be sure to clearly describe the the applicant’s business and how the credit being requested will specifically enable or incentivize the proposed expansion. If needed, please use this space to expand upon the purpose, location, or scope of the project. The summary should convey a clear understanding of the types of activities that will take place such as the nature of the work (e.g., widget manufacturing), classification(s) of full-time employees being hired/retained (e.g., forklift drivers, scientists, machinists, etc.), and a general description of the nature of investments (e.g., building construction, manufacturing equipment, vehicles, etc.). Please do not provide a one-sentence response such as “Business expansion” or “Relocating manufacturing to a bigger facility in another city.”

B. Description of the Proposed Project

Select the box that best fits the project. If the project has multiple components such as growth and in-state relocation, select one of the boxes and elaborate in the project summary section the details regarding the activities that will take place as part of both the growth and in-state relocation.C. Chief Executive Officer, Chief Financial Officer Declarations

If a user answers “Yes” OR "It May" to either or both of the questions below in Figure 8, the applicant will be required in the second phase of the application process to submit a declaration affirming those statements are true along with additional details. The declaration will need to be signed by the applicant's Chief Executive Officer, President, Chief Financial Officer or other equivalent officer or representative.Figure 8: CEO, CFO Declarations

D. High Unemployment and High Poverty Areas

If an applicant answers “Yes” to the question in Figure 9, the applicant automatically moves into Phase II, regardless of its ratio. A list of “high unemployment” and “high poverty” areas (Cities or Counties) can be found by clicking on the “here” link as shown in Figure 9.Figure 9: High Unemployment or High Poverty

E. Proposed Increase of Employees and Investment

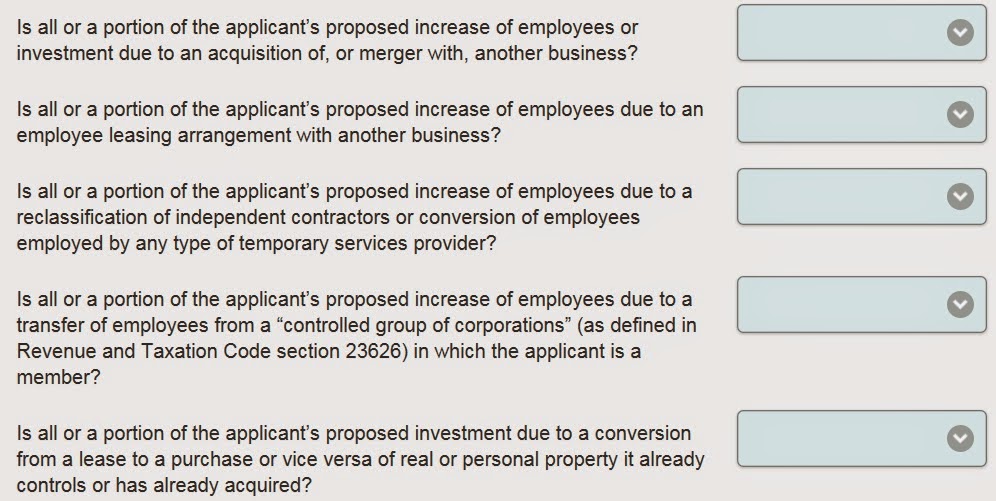

The questions in Figure 9 relate to the nature of the applicant’s proposed increases in employees or investments related to the project. The options for answering the questions are “Yes, No, Not Applicable.” Users answering “Yes” to any of the questions will be asked to provide additional information in the second phase of the application evaluation process (if the application is moved to the second phase).Figure 10: Employee & Investment Input Section

F. Total Amount of California Competes Tax Credit Requested

Enter the total amount of California Competes Tax Credit the applicant is requesting. The minimum request is $20,000 and the maximum is limited by statute to 20% of the total amount available for the fiscal year. The minimum and maximum amounts will appear in the text field as shown in Figure 11. Remember that this is the amount you are requesting for the full 5 years of the proposed project. In other words, if you need $20,000 per year for the next 5 years to ensure the success of your project, you would request $100,000 in this section ($20,000 per year x 5 years = $100,000).Figure 11: Credit Requested Input Section

Note: The California Competes Tax Credit is a non-refundable tax credit. If the tax credit exceeds the amount of tax due in the tax year the credit is allowed, the excess may be carried over to reduce the applicant’s tax in the following tax year, and the succeeding five tax years if necessary, until exhausted.